Since the launch of Bitcoin a decade ago, the blockchain has continued to grow in popularity. It has found use cases outside of cryptocurrency. In the fintech industry, technology is making a huge impact. As a result, startups and mainstream companies in the finance world are showing a lot of interest in this technology.

Since the launch of Bitcoin a decade ago, the blockchain has continued to grow in popularity. It has found use cases outside of cryptocurrency. In the fintech industry, technology is making a huge impact. As a result, startups and mainstream companies in the finance world are showing a lot of interest in this technology.

We are living in a new world. The last few years have been instrumental in positive changes in both the financial and technological sectors. In the last few months, we’ve seen a major surge in ‘DeFi services’ and we want to help you understand why products such as Raise will help mold and revolutionize the way we think of money.

We are living in a new world. The last few years have been instrumental in positive changes in both the financial and technological sectors. In the last few months, we’ve seen a major surge in ‘DeFi services’ and we want to help you understand why products such as Raise will help mold and revolutionize the way we think of money.

There’s no doubt that the Fintech software development industry has attracted a lot of attention from consumers and investors alike. In Finance, Fintech is synonymous with convenience, innovation, and accessibility. With the enormous solutions that Fintech promises to offer, it’s no wonder venture capitalists are willing to put their money in Fintech startups.

There’s no doubt that the Fintech software development industry has attracted a lot of attention from consumers and investors alike. In Finance, Fintech is synonymous with convenience, innovation, and accessibility. With the enormous solutions that Fintech promises to offer, it’s no wonder venture capitalists are willing to put their money in Fintech startups.

In the past few years, Southeast Asia has become a leader in the financial revolution. As a region with a dynamic economy, Southeast Asia presents an excellent opportunity for digital payment services, such as e-wallet and internet banking solutions to prosper.

In the past few years, Southeast Asia has become a leader in the financial revolution. As a region with a dynamic economy, Southeast Asia presents an excellent opportunity for digital payment services, such as e-wallet and internet banking solutions to prosper.

The applications for biometric recognition are numerous, but in this article, I’ll specifically look into one—bio-acquiring, or biometrics-enabled payments.

The applications for biometric recognition are numerous, but in this article, I’ll specifically look into one—bio-acquiring, or biometrics-enabled payments.

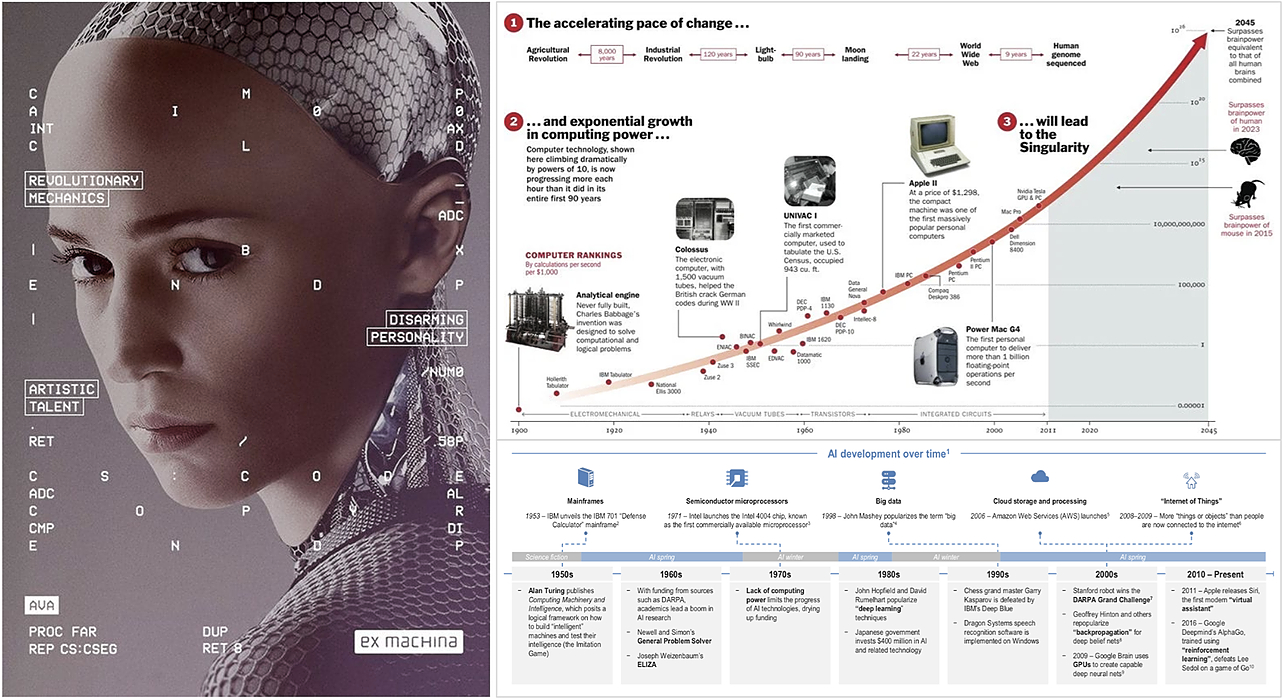

Innovations in fintech are usually given much attention because of the massive impact they have on everyone. The advent of smart payment solutions and digital financial products have helped both big businesses and average consumers in streamlining financial transactions. These days, machine-learning models, AI, and other similar technologies are paving the way for even more innovation and convenience in the financial services domain.

Innovations in fintech are usually given much attention because of the massive impact they have on everyone. The advent of smart payment solutions and digital financial products have helped both big businesses and average consumers in streamlining financial transactions. These days, machine-learning models, AI, and other similar technologies are paving the way for even more innovation and convenience in the financial services domain.

Technology is a necessity and it's hard to imagine doing anything without these innovations these days. The tech-crazy only gets bigger every year so it is expected to cover a bigger variety of industries and locations the following year. 2020 promises a new start now only because it’s a new decade. It will be an important year for tech lovers since a lot of innovations and advanced technologies we’ve been hearing about will finally be accessible for the public. We’ve combined a list of top 5 tech trends that you should look out for in the following year.

Technology is a necessity and it's hard to imagine doing anything without these innovations these days. The tech-crazy only gets bigger every year so it is expected to cover a bigger variety of industries and locations the following year. 2020 promises a new start now only because it’s a new decade. It will be an important year for tech lovers since a lot of innovations and advanced technologies we’ve been hearing about will finally be accessible for the public. We’ve combined a list of top 5 tech trends that you should look out for in the following year.

How does FinTech software development affect business success? ✅ Are FinTech development services relevant in 2022?

How does FinTech software development affect business success? ✅ Are FinTech development services relevant in 2022?

Of almost 500 subjects in the latest KickAcademy (that is Kick Ecosystem's innovative institute) survey made up of Blockchain insiders, crypto traders, and investors, roughly half are referral program participants who consider these programs a good source of passive income.

Of almost 500 subjects in the latest KickAcademy (that is Kick Ecosystem's innovative institute) survey made up of Blockchain insiders, crypto traders, and investors, roughly half are referral program participants who consider these programs a good source of passive income.

The 6 technology trends we've discussed in this article cumulatively pave the way for greater efficiency and security for the FinTech world.

The 6 technology trends we've discussed in this article cumulatively pave the way for greater efficiency and security for the FinTech world.

The world of banking and financial services has changed drastically over the past few years. The rise of technological innovation in banking and fintech sector has changed the way banking software companies have been operating. There has been a rush of cryptocurrencies powered by Blockchain, along with the AI automation that has disrupted the banking and financial space for better.

The world of banking and financial services has changed drastically over the past few years. The rise of technological innovation in banking and fintech sector has changed the way banking software companies have been operating. There has been a rush of cryptocurrencies powered by Blockchain, along with the AI automation that has disrupted the banking and financial space for better.

You can read the first part of this article here. For those who for some reason don’t like to follow the links, let me remind you briefly: in the first part, we made a retrospective of fintech trends in 2020 and delved into the first 5 trends in 2021.

You can read the first part of this article here. For those who for some reason don’t like to follow the links, let me remind you briefly: in the first part, we made a retrospective of fintech trends in 2020 and delved into the first 5 trends in 2021.

An article about the most promising trends and forecasts in lending technology one should be on the lookout for in 2022.

An article about the most promising trends and forecasts in lending technology one should be on the lookout for in 2022.

Following the Silicon Valley Bank collapse, the FinTech industry faces unprecedented territory in both crisis management and opportunity.

Following the Silicon Valley Bank collapse, the FinTech industry faces unprecedented territory in both crisis management and opportunity.

FinTechs and neobanks are prone to adopting the most innovative technologies, such as cloud computing and blockchain technology

FinTechs and neobanks are prone to adopting the most innovative technologies, such as cloud computing and blockchain technology

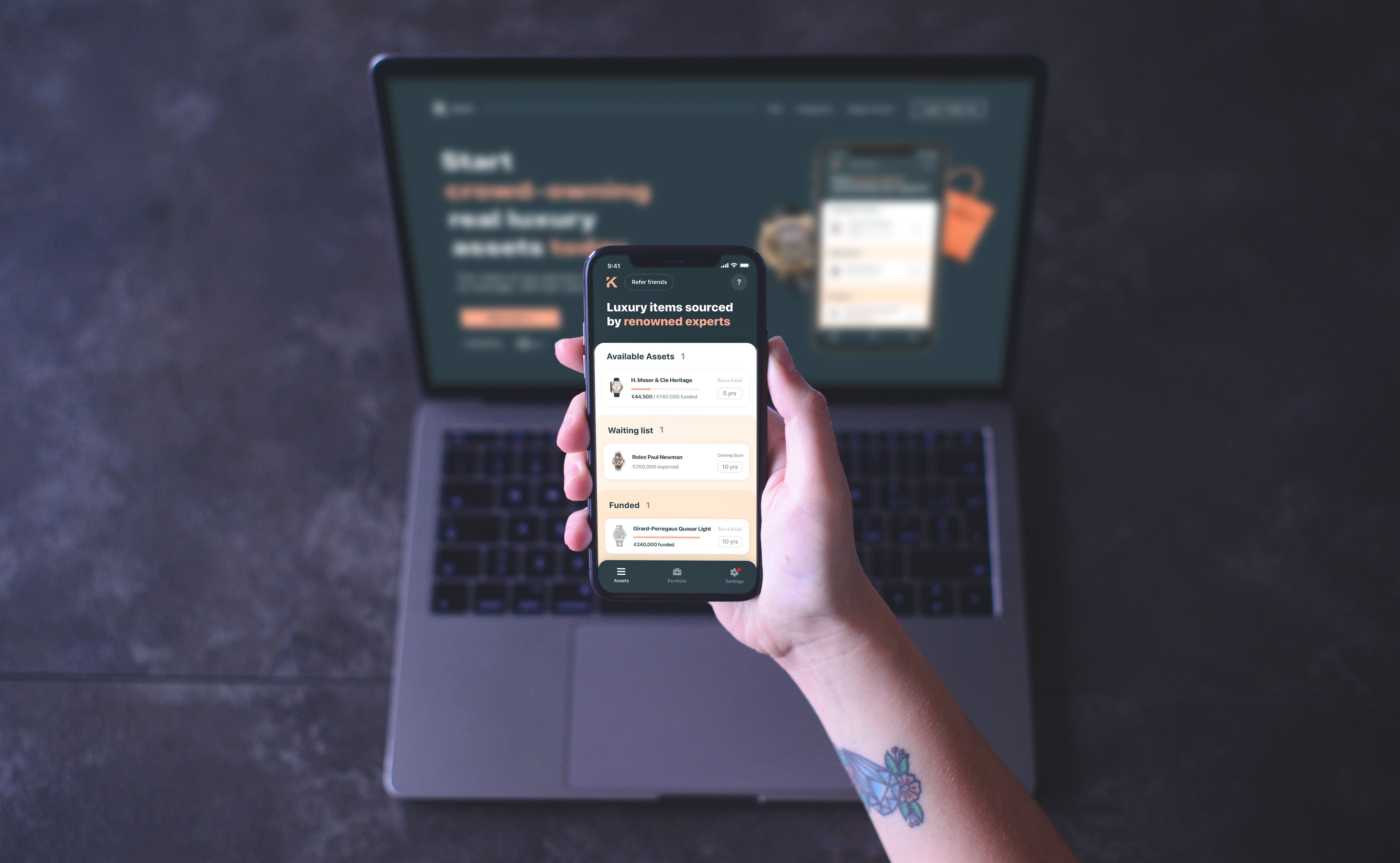

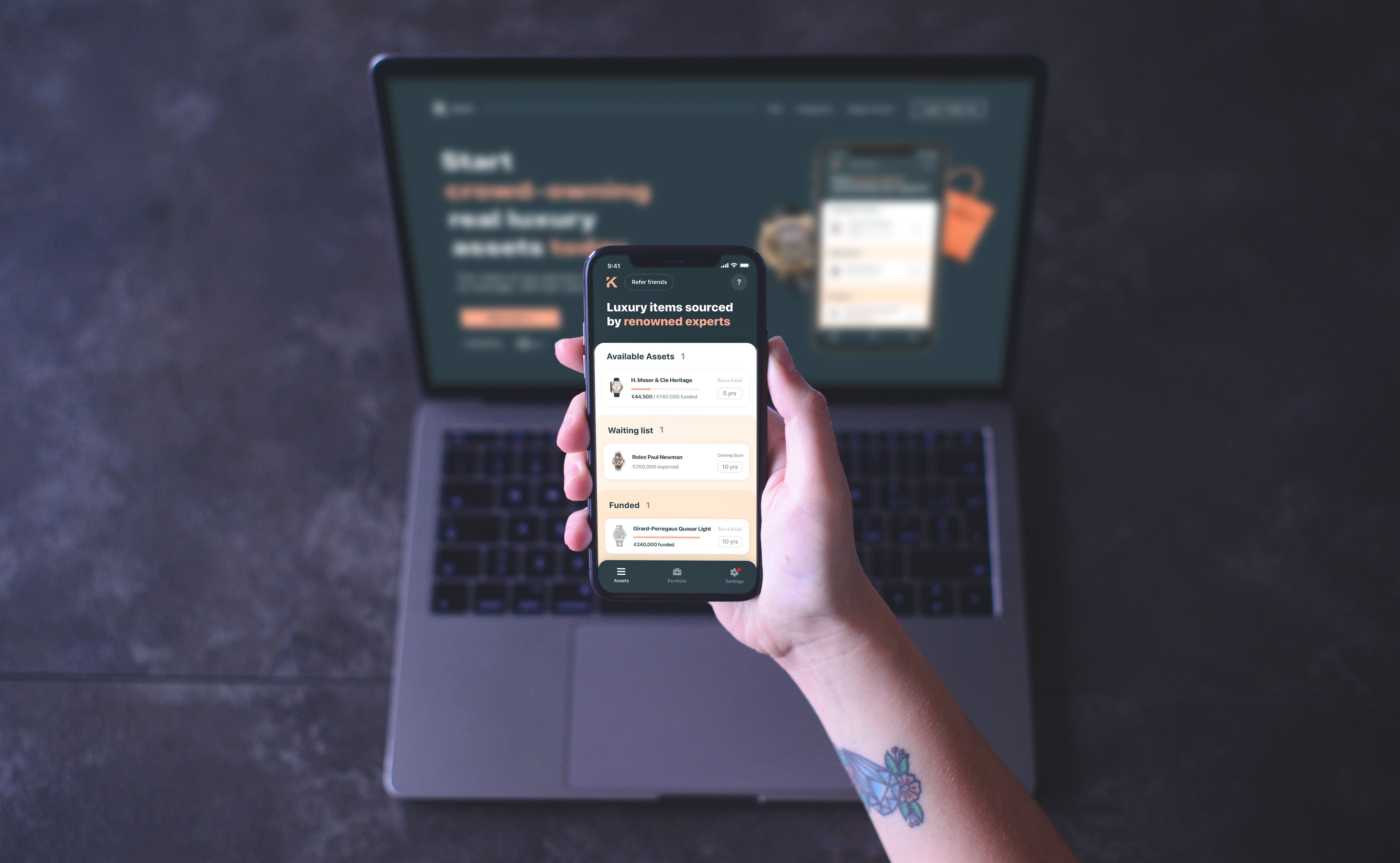

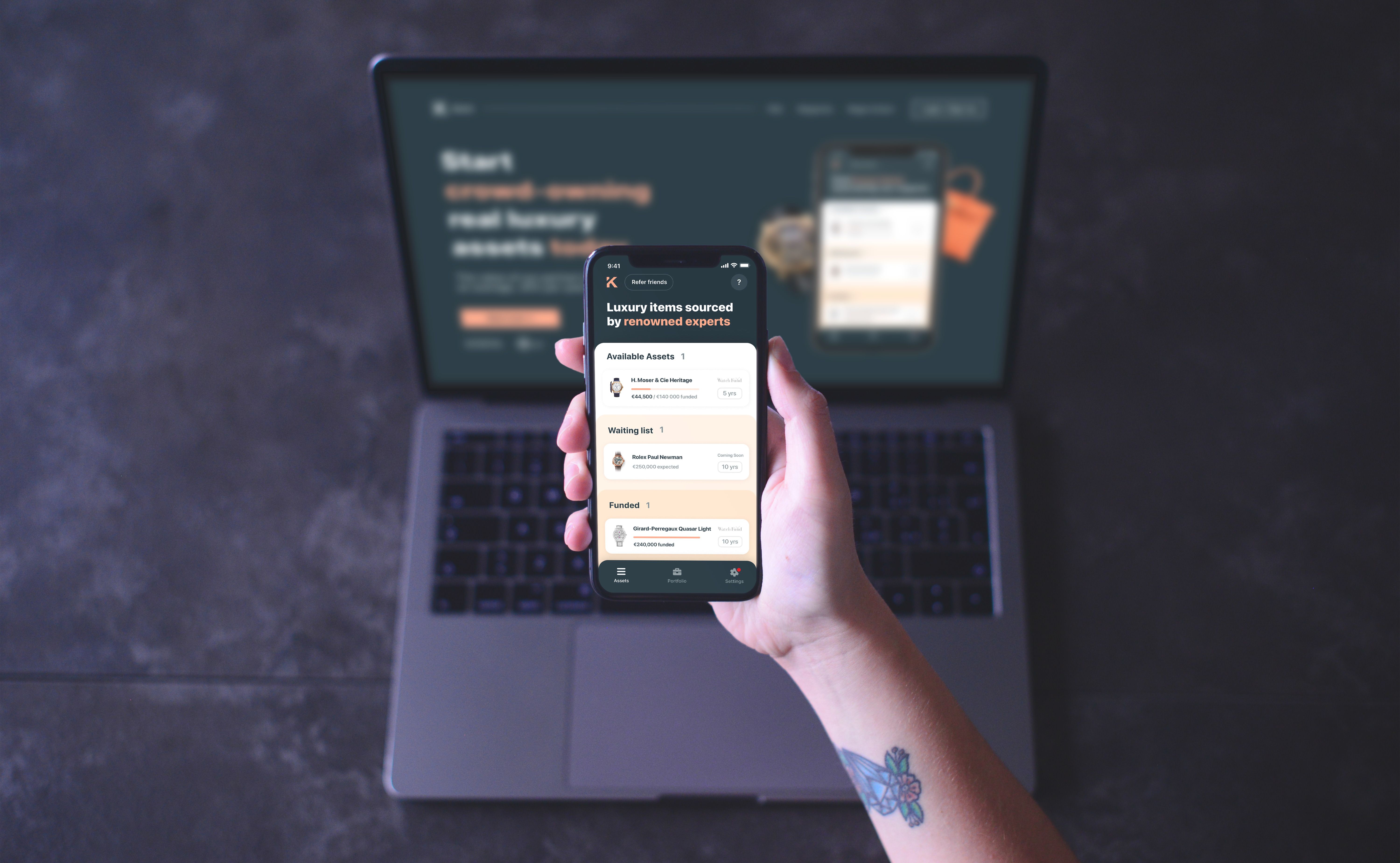

Ioana started her career as a software developer, but decided to leave Shopify to found Konvi - the investment platform for alternative assets.

Ioana started her career as a software developer, but decided to leave Shopify to found Konvi - the investment platform for alternative assets.

While some endorse IEOs, Kick Ecosystem’s CEO Danilevski argues that they’re a dangerous scam enterprise which will soon be replaced by the much more secure STOs and honest utility token sales.

While some endorse IEOs, Kick Ecosystem’s CEO Danilevski argues that they’re a dangerous scam enterprise which will soon be replaced by the much more secure STOs and honest utility token sales.

The cryptocurrency space has grown in leaps and bounds since the introduction of bitcoin in 2009. The year 2021, apart from being the beginning of a new decade,

The cryptocurrency space has grown in leaps and bounds since the introduction of bitcoin in 2009. The year 2021, apart from being the beginning of a new decade,

The future of money is clearly digital, powered by decentralized blockchain technology.

The future of money is clearly digital, powered by decentralized blockchain technology.

Daumantas Barauskas, COO of Genome, shares with us Genome's origin story, technology to be excited about and the future of fintech in the Startups interview.

Daumantas Barauskas, COO of Genome, shares with us Genome's origin story, technology to be excited about and the future of fintech in the Startups interview.

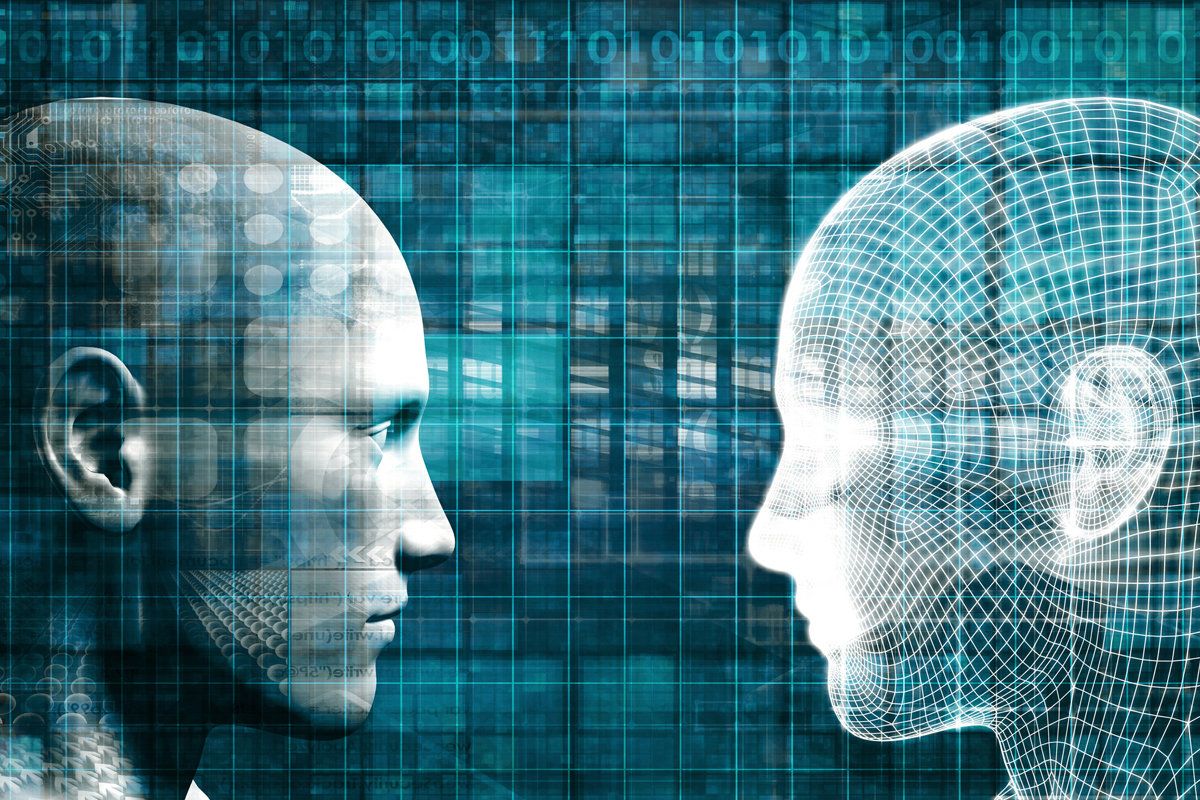

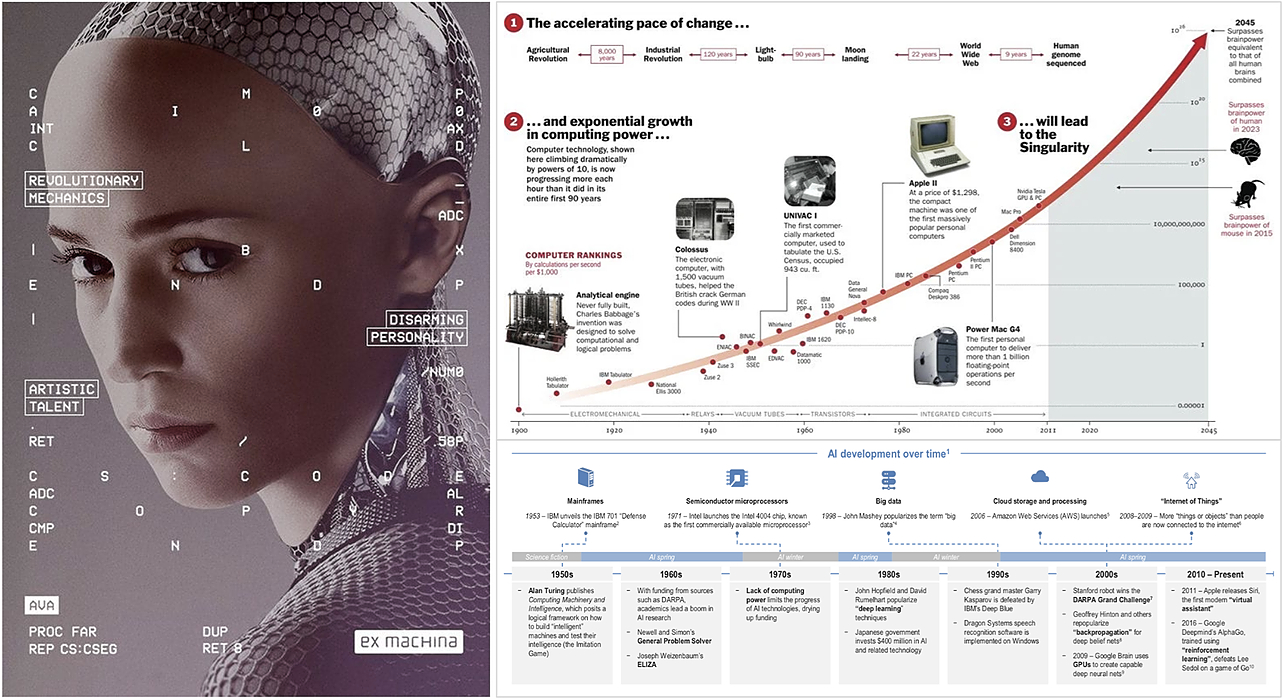

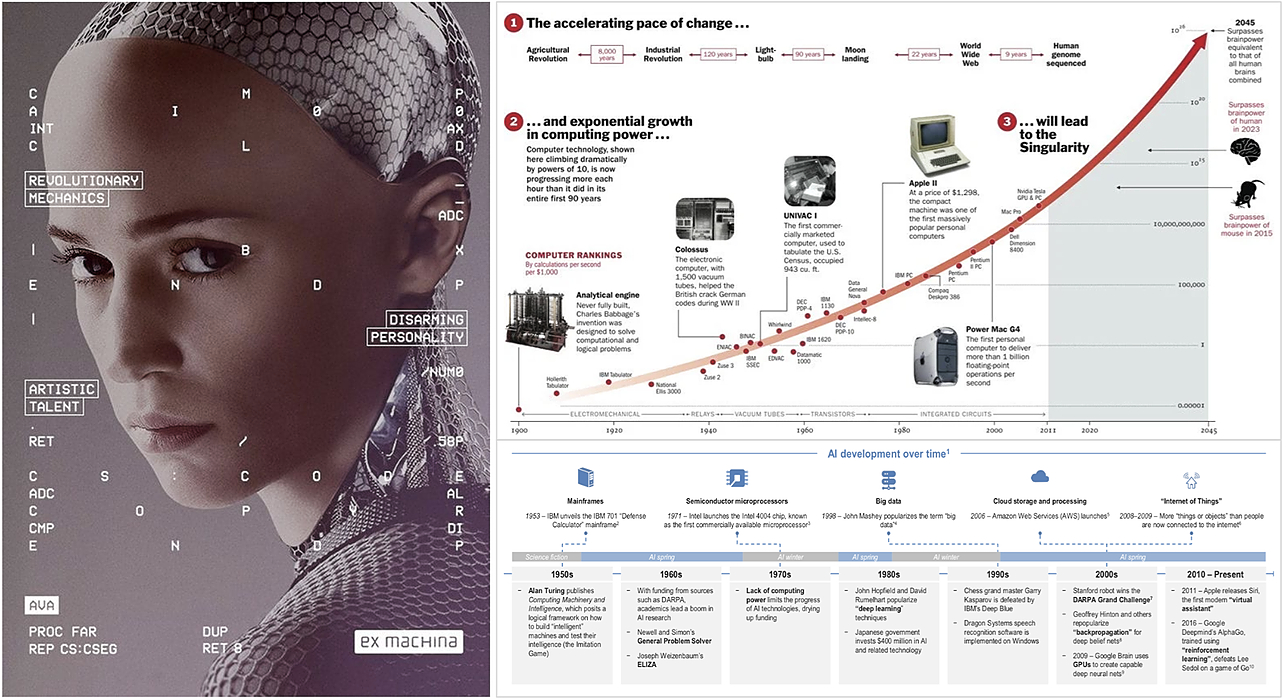

Artificial Intelligence is no longer in its infancy. In an age where algorithms can comprehend complex language, drive safely on busy roads, and even diagnose illnesses, it is fair to say that the field has advanced far enough as to have genuine, real-world implications.

Artificial Intelligence is no longer in its infancy. In an age where algorithms can comprehend complex language, drive safely on busy roads, and even diagnose illnesses, it is fair to say that the field has advanced far enough as to have genuine, real-world implications.

Finance technology has a broad scope of application that keeps revolutionizing the field. Here is an overview of the main 6 ones that enable business growth.

Finance technology has a broad scope of application that keeps revolutionizing the field. Here is an overview of the main 6 ones that enable business growth.

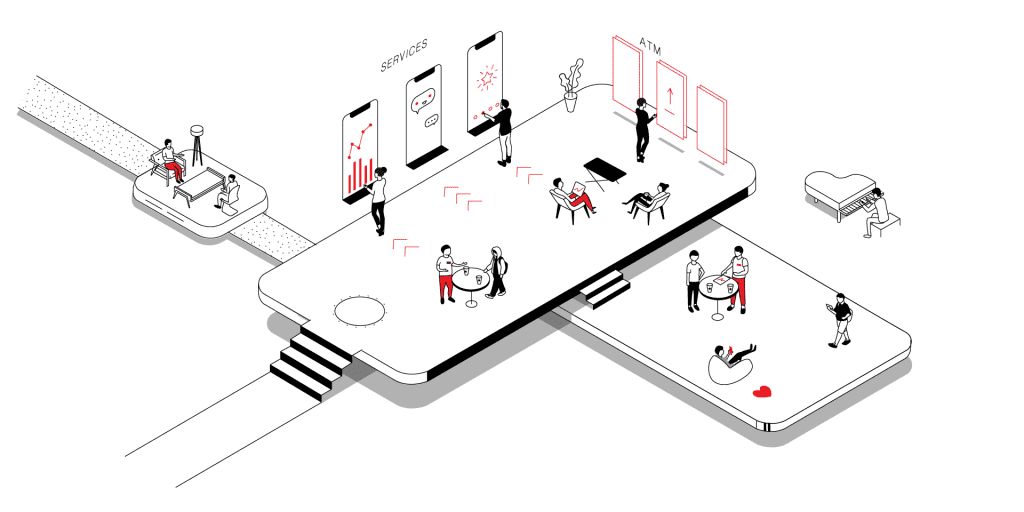

Financial technologies are rapidly transforming from futuristic imaginings into an inextricable component of everyday life. Back in 2016, such services as Apple Pay and Samsung Pay were just entering the global market as newfangled inventions, while today, they are used to processing three times more transactions than those made using conventional plastic bank cards. Mobile apps have since largely replaced bank office branches, and the coronavirus pandemic has only accelerated the trend. Taking into account the rapid pace of development of the fintech sector and speed at which modern users adapt to innovations, our experience of interacting with financial institutions is likely to undergo radical changes over the next few years.

Financial technologies are rapidly transforming from futuristic imaginings into an inextricable component of everyday life. Back in 2016, such services as Apple Pay and Samsung Pay were just entering the global market as newfangled inventions, while today, they are used to processing three times more transactions than those made using conventional plastic bank cards. Mobile apps have since largely replaced bank office branches, and the coronavirus pandemic has only accelerated the trend. Taking into account the rapid pace of development of the fintech sector and speed at which modern users adapt to innovations, our experience of interacting with financial institutions is likely to undergo radical changes over the next few years.

Name one instance in history when the ruling class represented by governments would voluntarily give up the most lucrative of all possible activities.

Name one instance in history when the ruling class represented by governments would voluntarily give up the most lucrative of all possible activities.

According to Tearsheet:

According to Tearsheet:

Cape is a technology startup developing corporate cards designed to save businesses time and money.

Cape is a technology startup developing corporate cards designed to save businesses time and money.

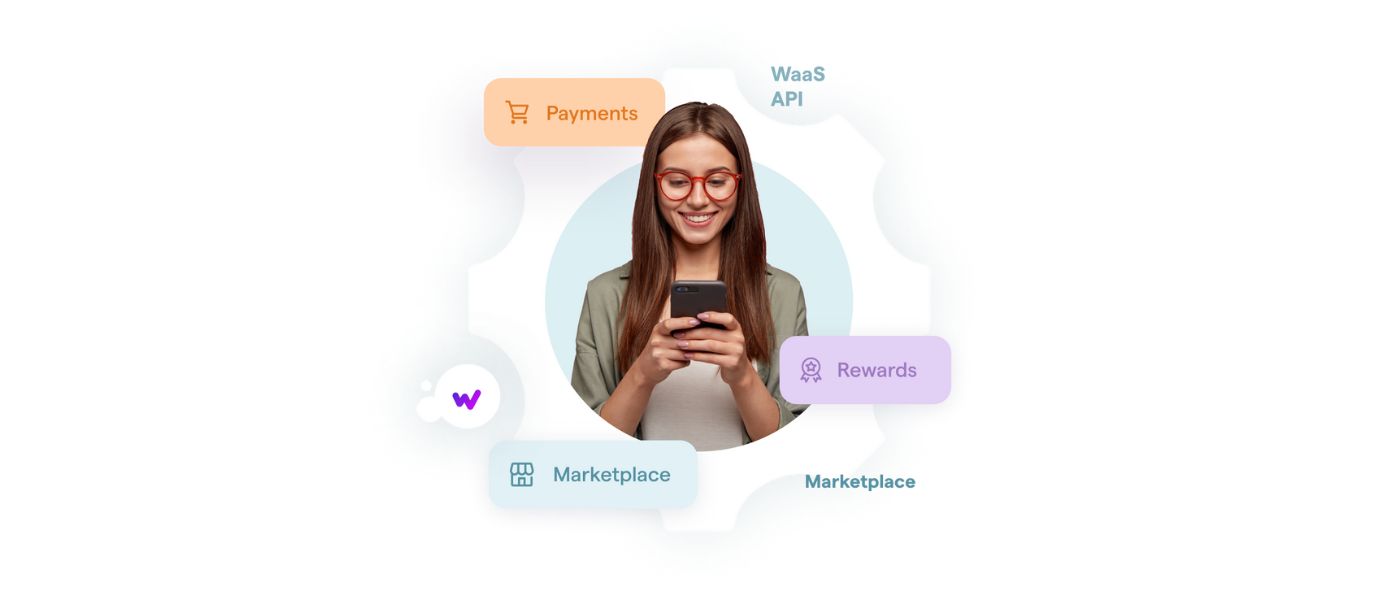

WaaS, or Wallet-as-a-Service, is an innovative FinTech delivery model that allows financial companies to jumpstart their eWallet businesses from scratch.

WaaS, or Wallet-as-a-Service, is an innovative FinTech delivery model that allows financial companies to jumpstart their eWallet businesses from scratch.

Check this in-depth guide to know the FinTech Mobile Application Development Cost, Industry Stats, Types of Apps, Top FinTech Apps, Tech Stack, and more!

Check this in-depth guide to know the FinTech Mobile Application Development Cost, Industry Stats, Types of Apps, Top FinTech Apps, Tech Stack, and more!

From the fraud prevention to driverless cars that navigate busy streets with ease, 2019 brought a dazzling array of artificial intelligence (AI) innovations. In 2020, AI is set to move towards collaboration in different sectors.

From the fraud prevention to driverless cars that navigate busy streets with ease, 2019 brought a dazzling array of artificial intelligence (AI) innovations. In 2020, AI is set to move towards collaboration in different sectors.

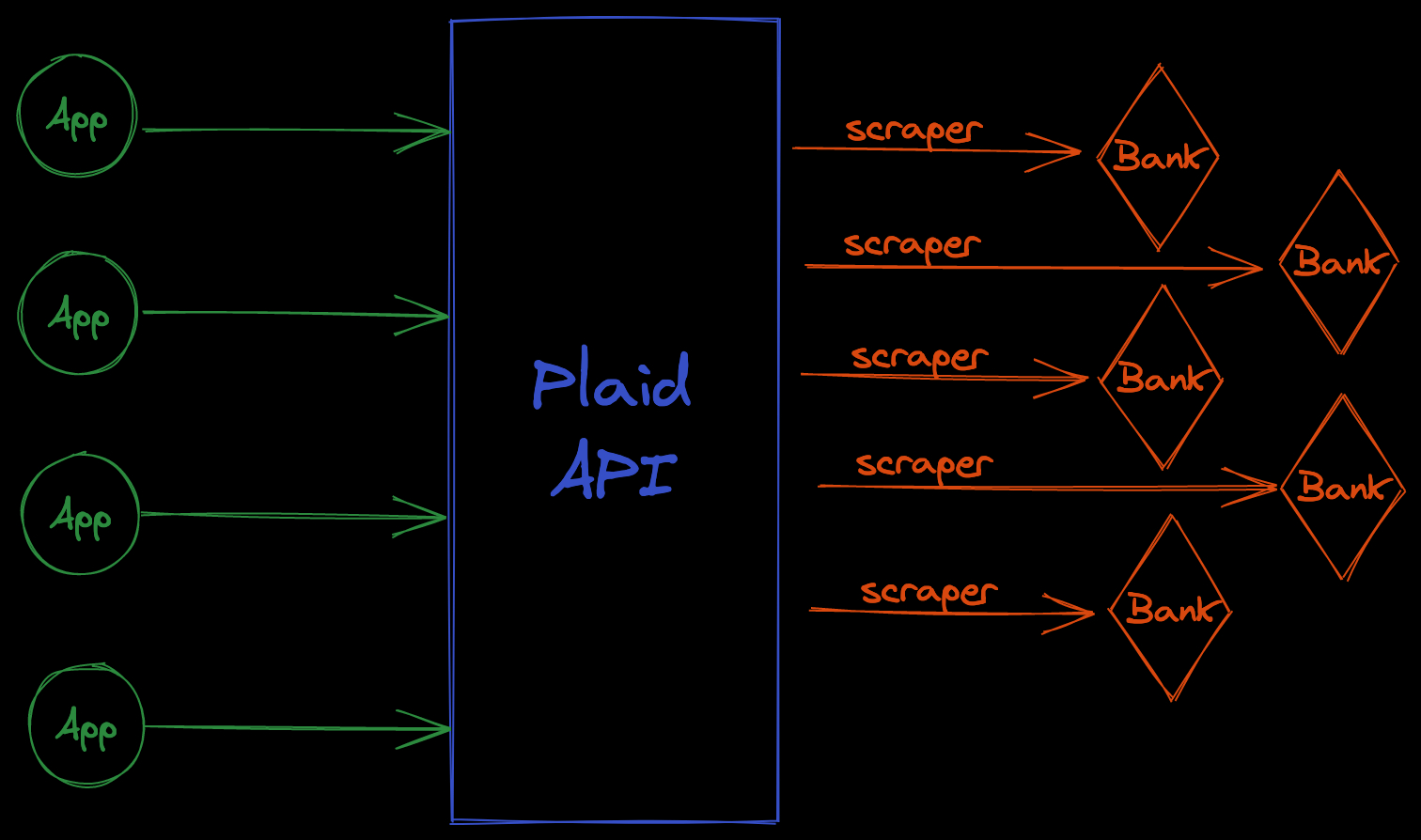

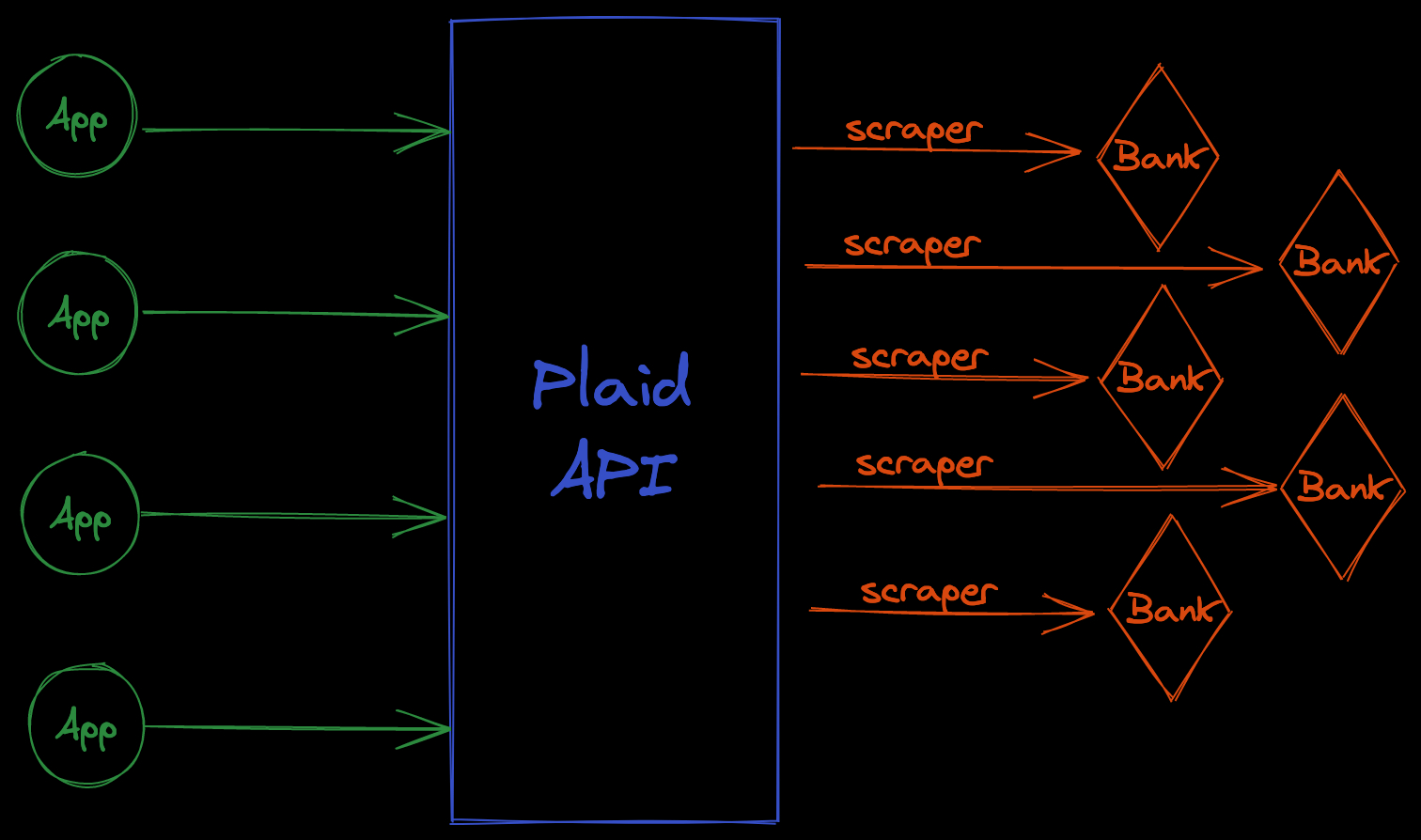

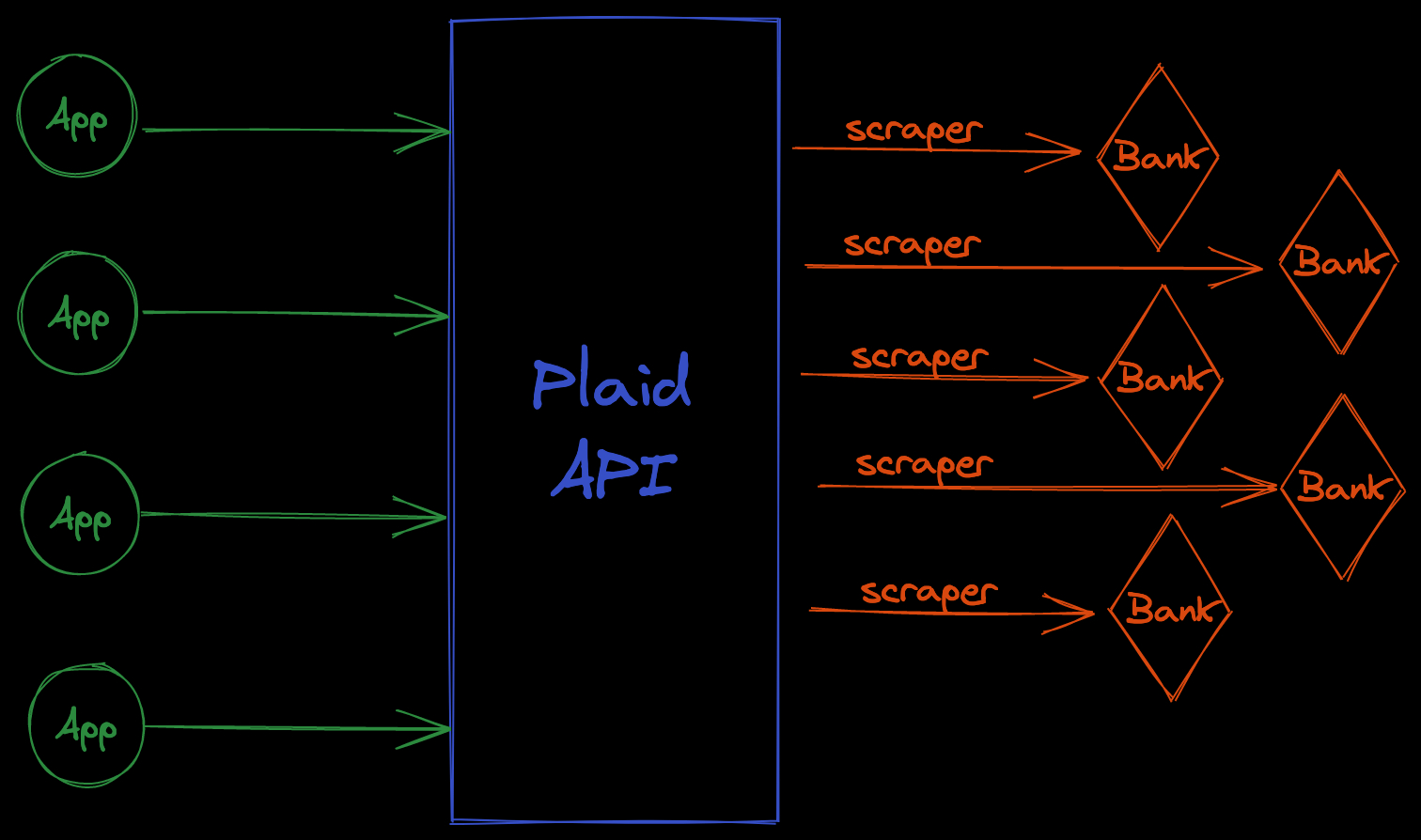

In the US, our financial data should be more easily accessible and transportable. This would make it simpler for more applications to be built to give us views into our financial life (bank account, brokerage, etc…). That in turn would allow different segments of the population to be better served for their needs.

In the US, our financial data should be more easily accessible and transportable. This would make it simpler for more applications to be built to give us views into our financial life (bank account, brokerage, etc…). That in turn would allow different segments of the population to be better served for their needs.

According to Investopedia:

According to Investopedia:

Technology keeps evolving, and the incorporation of technology helps businesses of varying types to make profits and meet customer needs better.

Technology keeps evolving, and the incorporation of technology helps businesses of varying types to make profits and meet customer needs better.

Robo advising isn't just a buzzword. In the U.S. today, there are already $980 million in assets managed by robo advisors. These aren’t slowing down anytime soon. In fact, they’re growing by a rate of 27% annually.

Robo advising isn't just a buzzword. In the U.S. today, there are already $980 million in assets managed by robo advisors. These aren’t slowing down anytime soon. In fact, they’re growing by a rate of 27% annually.

We'll look at the present state of the fintech industry, current trends for 2022 and beyond, and the number of resources required to run an effective project.

We'll look at the present state of the fintech industry, current trends for 2022 and beyond, and the number of resources required to run an effective project.

In this article, we’ll explore how DevOps fits into a FinTech world. We’ll look at the approach you should take in developing your unique DevOps culture.

In this article, we’ll explore how DevOps fits into a FinTech world. We’ll look at the approach you should take in developing your unique DevOps culture.

There are plenty of reasons for enterprises that work with cardholder data to care about payment card industry (PCI) compliance.

There are plenty of reasons for enterprises that work with cardholder data to care about payment card industry (PCI) compliance.

Learn how banks can leverage conversational AI and stay relevant in the age of FinTech including the rise of contactless payment methods, omnichannel, and more.

Learn how banks can leverage conversational AI and stay relevant in the age of FinTech including the rise of contactless payment methods, omnichannel, and more.

The rising prevalence of cryptocurrencies and people buying into it has increased the influence of the industry on the finance sector which will grow with time.

The rising prevalence of cryptocurrencies and people buying into it has increased the influence of the industry on the finance sector which will grow with time.

The fintech industry is a prime target for fraudsters. Here are 4 methods of fraud prevention in the industry.

The fintech industry is a prime target for fraudsters. Here are 4 methods of fraud prevention in the industry.

Fintech startups must be faster to stay competitive, and no-code solutions can be one of the ways to compete in this race.

Fintech startups must be faster to stay competitive, and no-code solutions can be one of the ways to compete in this race.

Traditionally, the Financial Services industry has been a ‘stale’ and carefully regulated space.

Traditionally, the Financial Services industry has been a ‘stale’ and carefully regulated space.

Technology is reshaping the operating-model of financial institutions fundamentally, and the attributes necessary to build a successful business.

Technology is reshaping the operating-model of financial institutions fundamentally, and the attributes necessary to build a successful business.

Although it may seem that the paradigm shift has just begun, the reality is that the financial services sector has already undergone significant changes. Merely think of mobile banking apps, contactless payments, online money transfers, crypto platforms, robo-advisors, and crowdfunding marketplaces. And fintech innovation has definitely had a hand in this evolution.

Although it may seem that the paradigm shift has just begun, the reality is that the financial services sector has already undergone significant changes. Merely think of mobile banking apps, contactless payments, online money transfers, crypto platforms, robo-advisors, and crowdfunding marketplaces. And fintech innovation has definitely had a hand in this evolution.

Want to find out what's next in FinTech and the importance of scalable, reliable technologies in the sector? Abstract from new 'FinTech Trends in 2021 Report'.

Want to find out what's next in FinTech and the importance of scalable, reliable technologies in the sector? Abstract from new 'FinTech Trends in 2021 Report'.

JPMorgan Global Markets Strategy last Friday published a research note touting Bitcoin as the alternative of gold for the millennials and predicting to potentially double or even triple the price. Ironically, only a few years ago JPMorgan CEO Jamie Dimon famously called Bitcoin a "fraud". Why did the major US bank make such a drastic shift in its view on Bitcoin? It was in part triggered by a major movement earlier in the week.

JPMorgan Global Markets Strategy last Friday published a research note touting Bitcoin as the alternative of gold for the millennials and predicting to potentially double or even triple the price. Ironically, only a few years ago JPMorgan CEO Jamie Dimon famously called Bitcoin a "fraud". Why did the major US bank make such a drastic shift in its view on Bitcoin? It was in part triggered by a major movement earlier in the week.

Digital banking is the way of the future, and the Asia-Pacific financial services industry needs to be prepared for the enormous changes that are on the horizon.

Digital banking is the way of the future, and the Asia-Pacific financial services industry needs to be prepared for the enormous changes that are on the horizon.

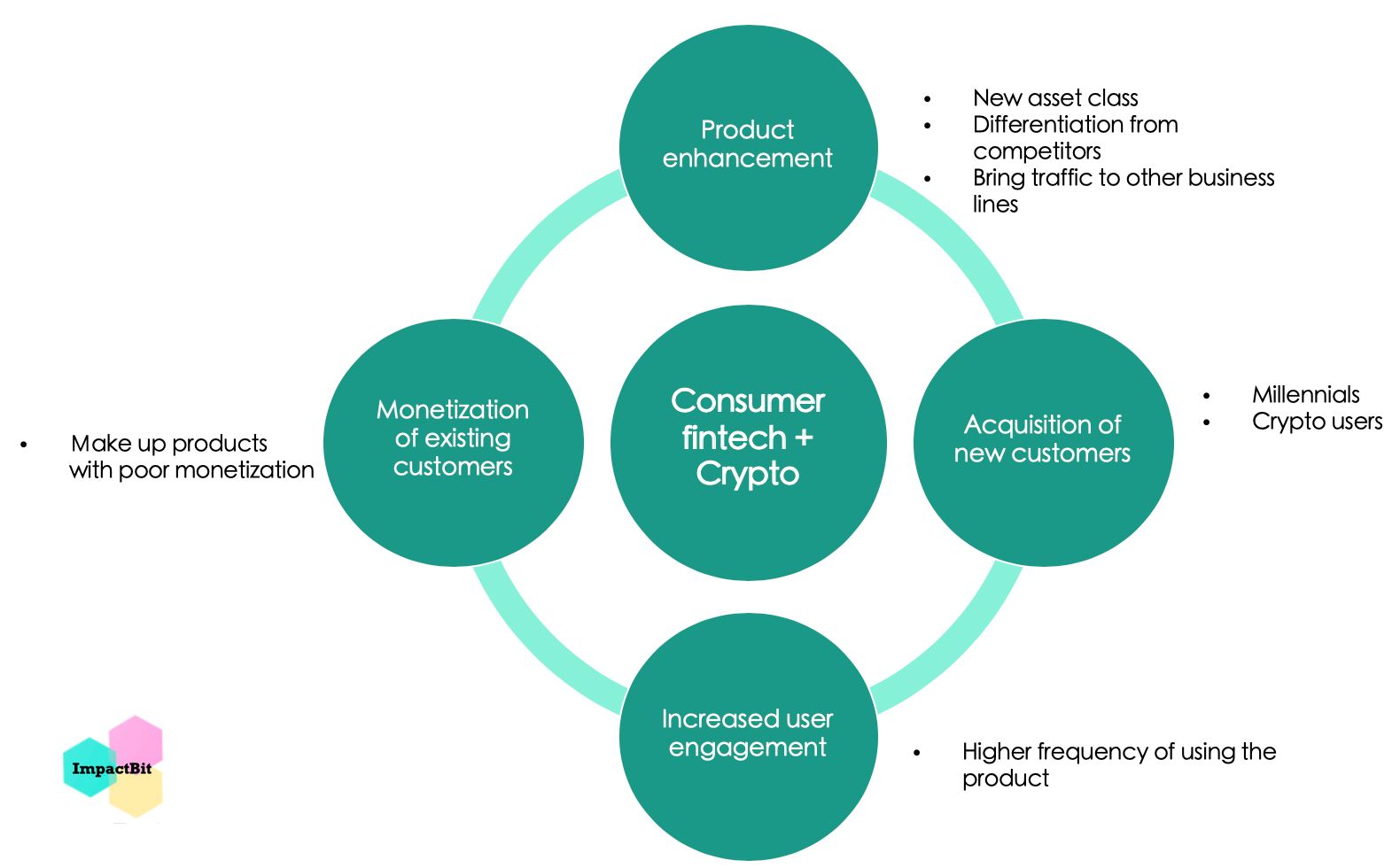

1+1>2

1+1>2

Finance has entered a phase of radical charge, promising much for both consumers and those leading the revolution.

Finance has entered a phase of radical charge, promising much for both consumers and those leading the revolution.

At the end of the year, two very important events took place in the crypto world. Many media mentioned them in passing, although the events are really significant.

At the end of the year, two very important events took place in the crypto world. Many media mentioned them in passing, although the events are really significant.

In the last 30 years, Internet and smartphones have led to an explosion in messaging volumes by driving the cost of messages down to zero, and the speed to infinity. Messaging apps are the quintessence of this transformation: free, instant, borderless communication at the tip of your finger any time of the day.

In the last 30 years, Internet and smartphones have led to an explosion in messaging volumes by driving the cost of messages down to zero, and the speed to infinity. Messaging apps are the quintessence of this transformation: free, instant, borderless communication at the tip of your finger any time of the day.

According to a study, 90% of the whole world’s data was created in the last two years. This sounds quite cool but what does the world do with all that data? How does one analyze it?

According to a study, 90% of the whole world’s data was created in the last two years. This sounds quite cool but what does the world do with all that data? How does one analyze it?

Fintech, otherwise known as the financial technology market, is on a very strong growth trajectory, having already disrupted the banking world in a powerful way. From mobile payments, to artificial intelligence, insurance and investment services, Fintech has gradually transformed the way we bank since the day the US Federal Reserve introduced the Fedwire Funds Service back in 1918, which used morse code and telegraph to transfer funds electronically.

Fintech, otherwise known as the financial technology market, is on a very strong growth trajectory, having already disrupted the banking world in a powerful way. From mobile payments, to artificial intelligence, insurance and investment services, Fintech has gradually transformed the way we bank since the day the US Federal Reserve introduced the Fedwire Funds Service back in 1918, which used morse code and telegraph to transfer funds electronically.

The banking sector is perhaps one of the major beneficiaries of modern advances in software technology. Today, payments, accounts and other finances could be easily handled through banking software, mobile banking applications, banking software among other banking solutions.

The banking sector is perhaps one of the major beneficiaries of modern advances in software technology. Today, payments, accounts and other finances could be easily handled through banking software, mobile banking applications, banking software among other banking solutions.

Everybody’s making predictions about 2020, mostly about the price of bitcoin.

Everybody’s making predictions about 2020, mostly about the price of bitcoin.

Traditional banks Vs. Neobanks

Traditional banks Vs. Neobanks

Here is the list of top 20 fintech startups that are shaping the future of finance and transforming financial services.

Here is the list of top 20 fintech startups that are shaping the future of finance and transforming financial services.

FinTech is revolutionizing financial services for the Millennial generation

FinTech is revolutionizing financial services for the Millennial generation

Cryptocurrency is full of people who believe in old economic theories that have never been tried in the real world. There’s an almost zealous adherence to esoteric principles that seem to have no place in our modern lives.

Cryptocurrency is full of people who believe in old economic theories that have never been tried in the real world. There’s an almost zealous adherence to esoteric principles that seem to have no place in our modern lives.

3D Secure 2.X guarantees a security for online businesses and consumers paired with a seamless transaction experience and high conversion rate on payments.

3D Secure 2.X guarantees a security for online businesses and consumers paired with a seamless transaction experience and high conversion rate on payments.

The year 2022 brought a number of financial problems for investors toward the end, a period which has become known as the crypto winter of 2022.

The year 2022 brought a number of financial problems for investors toward the end, a period which has become known as the crypto winter of 2022.

Let's explore how banks and credit unions can strategically counter the FinTech disruption in 2023 and beyond. Read on.

Let's explore how banks and credit unions can strategically counter the FinTech disruption in 2023 and beyond. Read on.

Nothing has been normal in the year since the world shutdown - but that hasn’t stopped the fintech engine of Singapore from continuing to accelerate.

Nothing has been normal in the year since the world shutdown - but that hasn’t stopped the fintech engine of Singapore from continuing to accelerate.

A country living under draconian restrictions, which also happens to be facing the biggest currency devaluation of the century. Venezuela should be fertile ground for mass cryptocurrency adoption. Is it? How’s Bitcoin doing in Venezuela, you ask?

A country living under draconian restrictions, which also happens to be facing the biggest currency devaluation of the century. Venezuela should be fertile ground for mass cryptocurrency adoption. Is it? How’s Bitcoin doing in Venezuela, you ask?

It’s not news that Fintech is booming. On the one hand, millions of Fintech start-ups appear every year to offer innovative services, channels, and approaches. On the other hand, existing financial institutions and companies are improving the technology side of their business and expanding market reach.

It’s not news that Fintech is booming. On the one hand, millions of Fintech start-ups appear every year to offer innovative services, channels, and approaches. On the other hand, existing financial institutions and companies are improving the technology side of their business and expanding market reach.

The rise of a global infrastructure facilitating cross-border settlements creates a real-time, highly-secure alternative to traditional payments.

The rise of a global infrastructure facilitating cross-border settlements creates a real-time, highly-secure alternative to traditional payments.

Account Aggregators (AAs) are about to take the fintech market by storm. Remember how UPI completely changed how people send money? No more awkwardly splitting restaurant bills, or digging for exact change to pay off that friend who's been bugging you for months.

Account Aggregators (AAs) are about to take the fintech market by storm. Remember how UPI completely changed how people send money? No more awkwardly splitting restaurant bills, or digging for exact change to pay off that friend who's been bugging you for months.

The COVID19 crisis has been playing out globally for over half a year, or almost a year counting its early phase in China. It’s been hurting a lot of sectors, but one particular sector stood to benefit — Fintech.

The COVID19 crisis has been playing out globally for over half a year, or almost a year counting its early phase in China. It’s been hurting a lot of sectors, but one particular sector stood to benefit — Fintech.

As CTO at Altar.io, a large part of my work revolves around observing the forward-looking industry trends (including fintech trends) that affect how we create innovative products.

As CTO at Altar.io, a large part of my work revolves around observing the forward-looking industry trends (including fintech trends) that affect how we create innovative products.

A specific opportunity that has significant growth potential in Indonesia is Islamic fintech. If successful, this form of fintech can greatly impact the world.

A specific opportunity that has significant growth potential in Indonesia is Islamic fintech. If successful, this form of fintech can greatly impact the world.

It’s fair to characterise Bitcoin as a reaction to the last global economic meltdown. At the time, this crypt offered great promise as a “safe haven” for investors against exactly the type of financial crash we saw in 2007/2008 and, with appalling (and predictable) inevitability, are seeing again now.

It’s fair to characterise Bitcoin as a reaction to the last global economic meltdown. At the time, this crypt offered great promise as a “safe haven” for investors against exactly the type of financial crash we saw in 2007/2008 and, with appalling (and predictable) inevitability, are seeing again now.

Just like UPI helps people share money between bank accounts seamlessly, the new Account Aggregator framework (AA) will help people share their financial data quickly and safely.

Just like UPI helps people share money between bank accounts seamlessly, the new Account Aggregator framework (AA) will help people share their financial data quickly and safely.

Wish to unlock new revenue paths for your business and that too from your existing products? Say hello to embedded banking & finance!

Wish to unlock new revenue paths for your business and that too from your existing products? Say hello to embedded banking & finance!

To help you keep up with all the latest FinTech innovations, we have compiled a list of seven emerging trends affecting the FinTech industry. Read now!

To help you keep up with all the latest FinTech innovations, we have compiled a list of seven emerging trends affecting the FinTech industry. Read now!

According to technological growth statistics, there are approximately 4.88 billion mobile phone users across the globe as of January 2021

According to technological growth statistics, there are approximately 4.88 billion mobile phone users across the globe as of January 2021

Big money, get paid. Tom Sosnoff, Co-CEO of tastytrade, and Sean Salas, CEO of Camino Financial, join Amy Tom this week to discuss FinTech startups. What is Wal

Big money, get paid. Tom Sosnoff, Co-CEO of tastytrade, and Sean Salas, CEO of Camino Financial, join Amy Tom this week to discuss FinTech startups. What is Wal

We continue to witness innovation in the FinTech sector — it seems that 2023 will equalize win-win opportunities for both consumers and financial institutions.

We continue to witness innovation in the FinTech sector — it seems that 2023 will equalize win-win opportunities for both consumers and financial institutions.