Various financial mathematics codes in Python for testing purposes.

See comment in files for what each does, but explanation is very limited.

Includes:

- Analytical pricing of European options under Black-Scholes-Merton, with Greeks

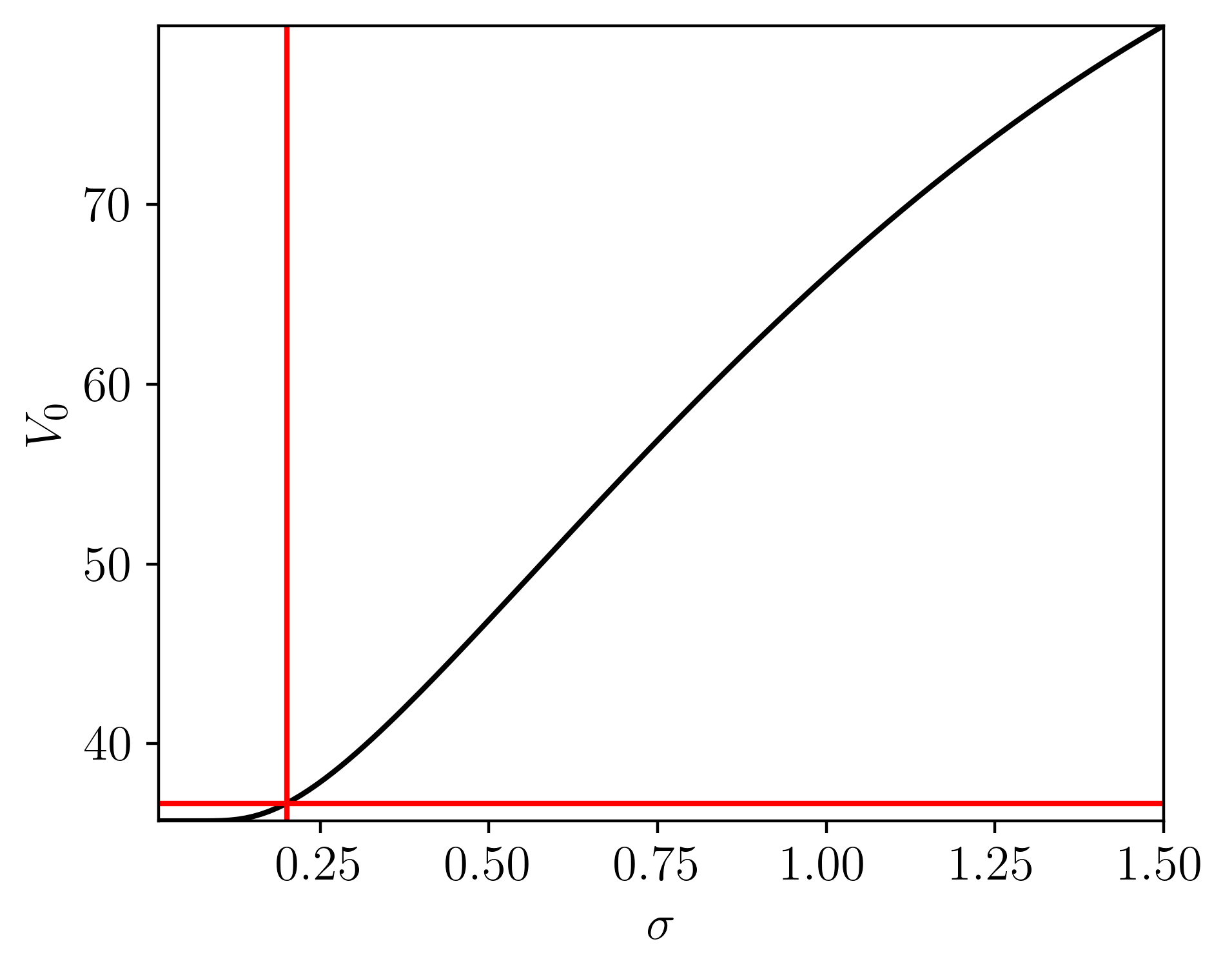

- Implied volatility calculation

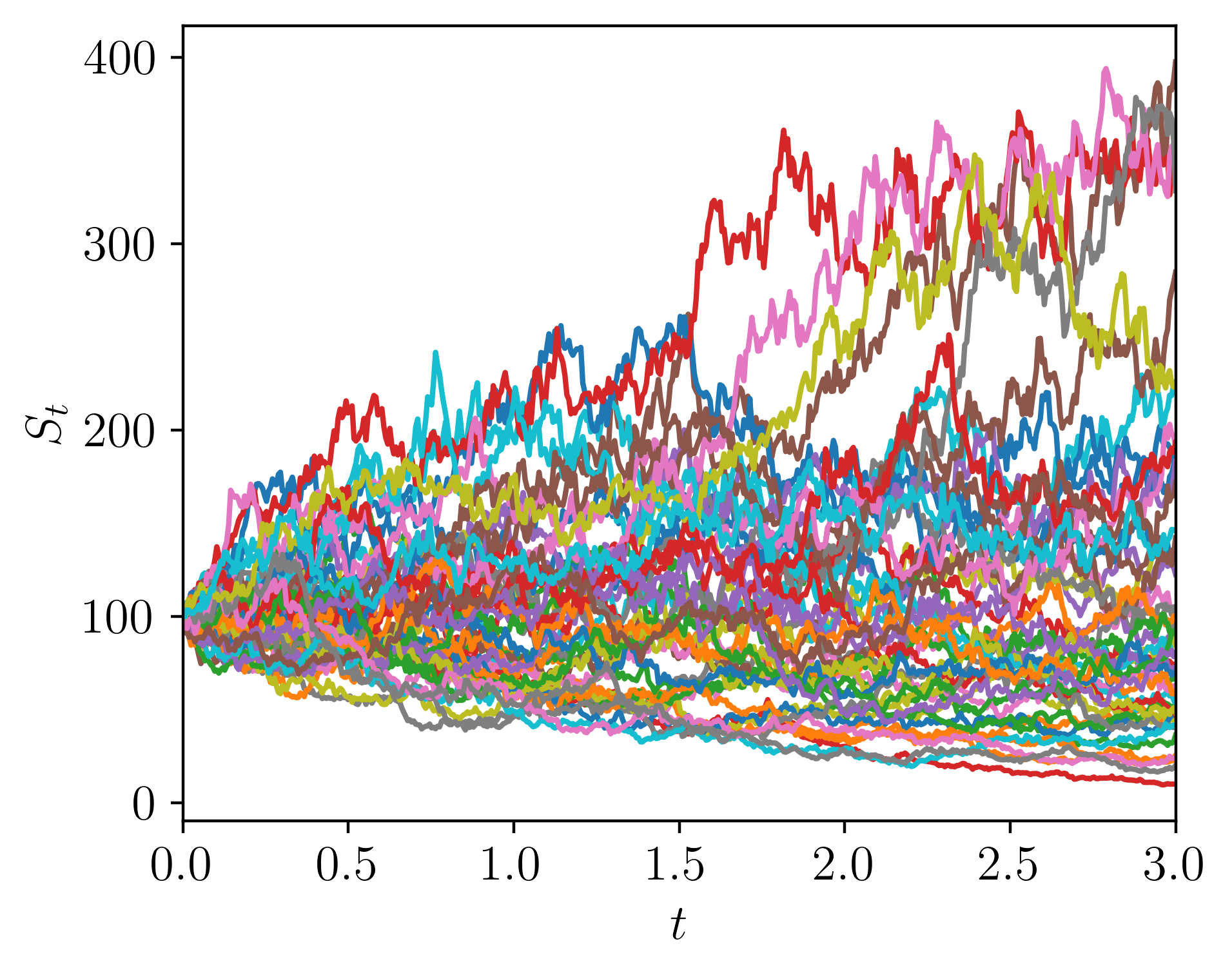

- Monte Carlo simulation (and European option pricing) for

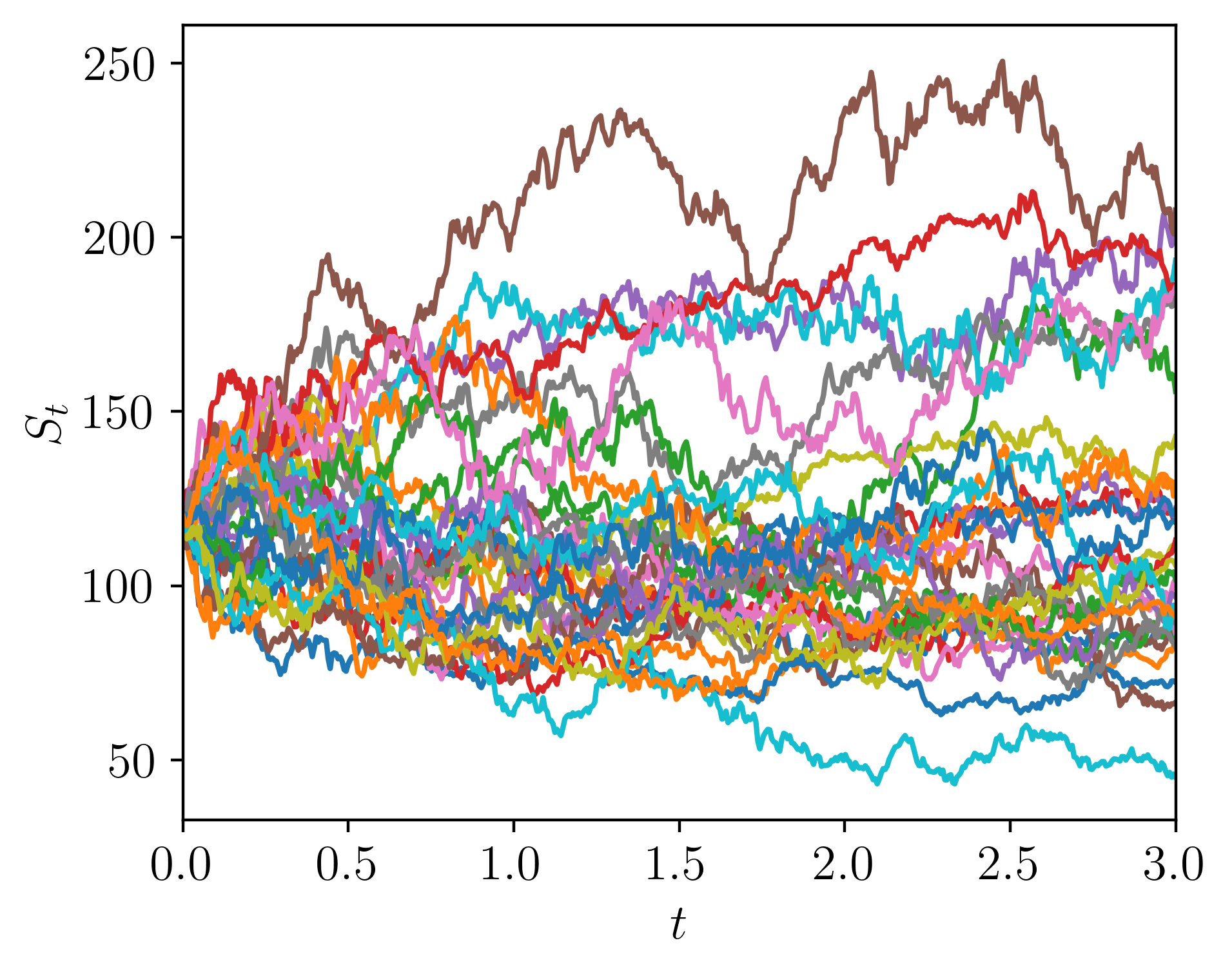

- Black-Scholes-Merton (with and without importance sampling)

- Cox-Ingersoll-Ross

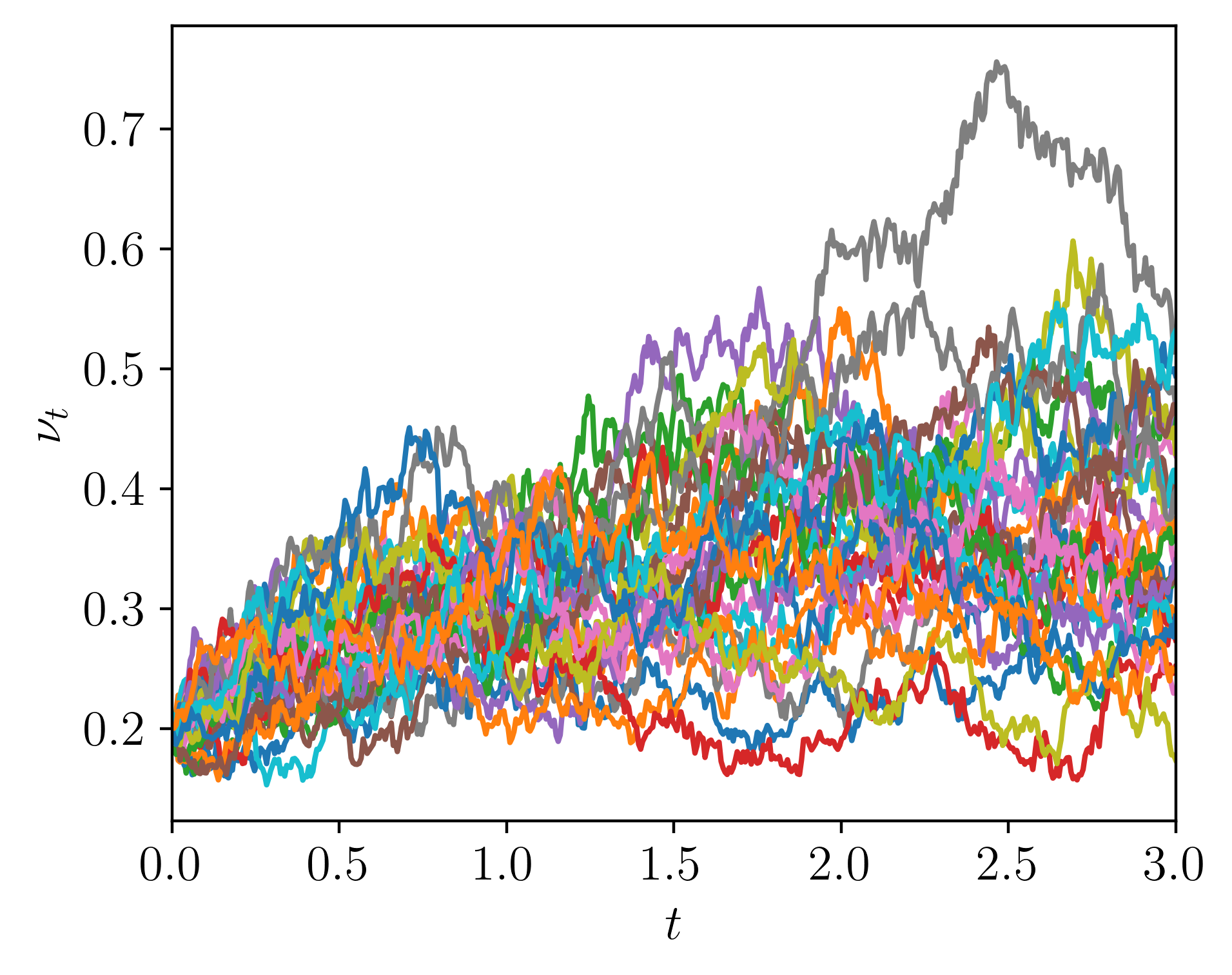

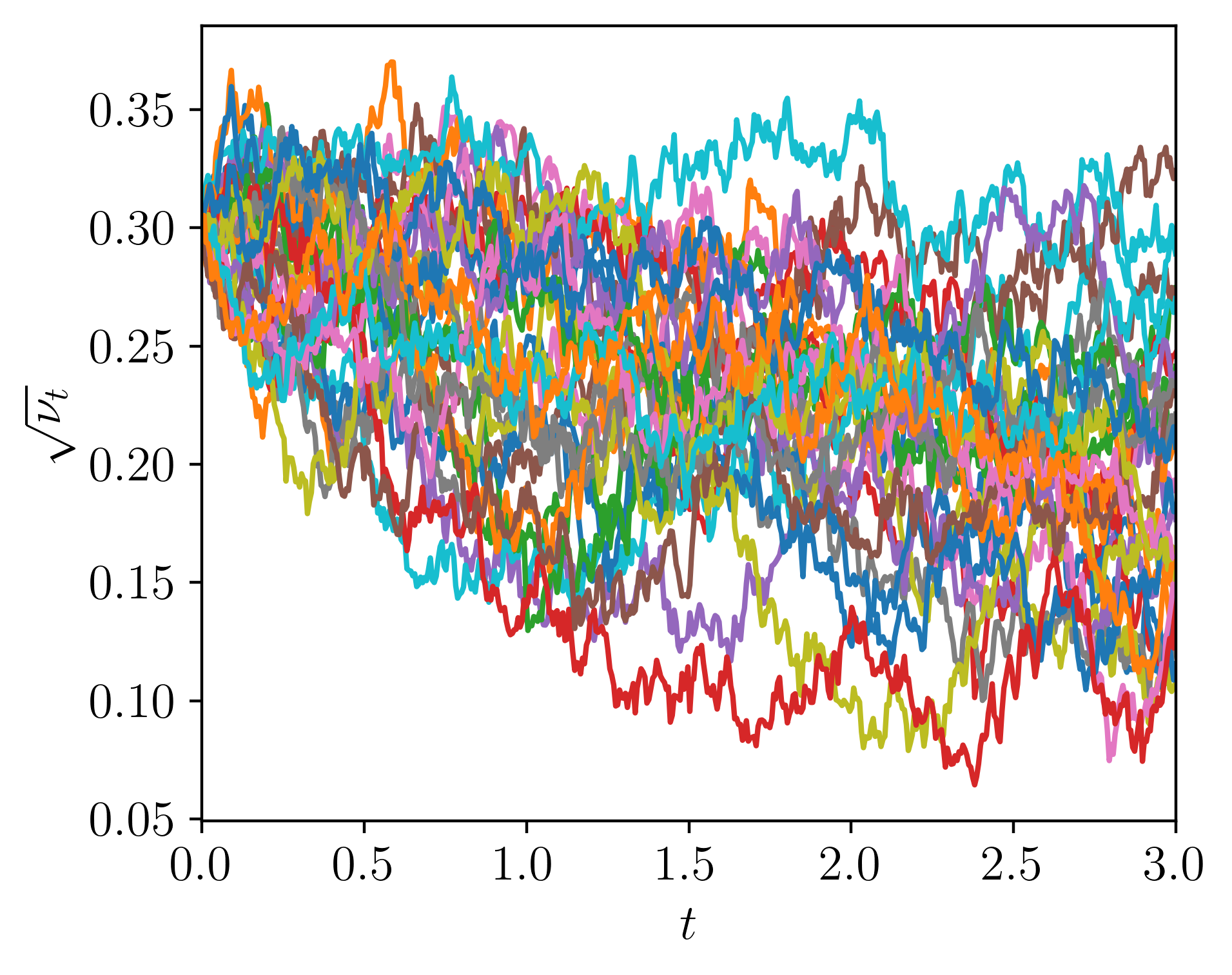

- Heston (with and without importance sampling and antithetic variates)

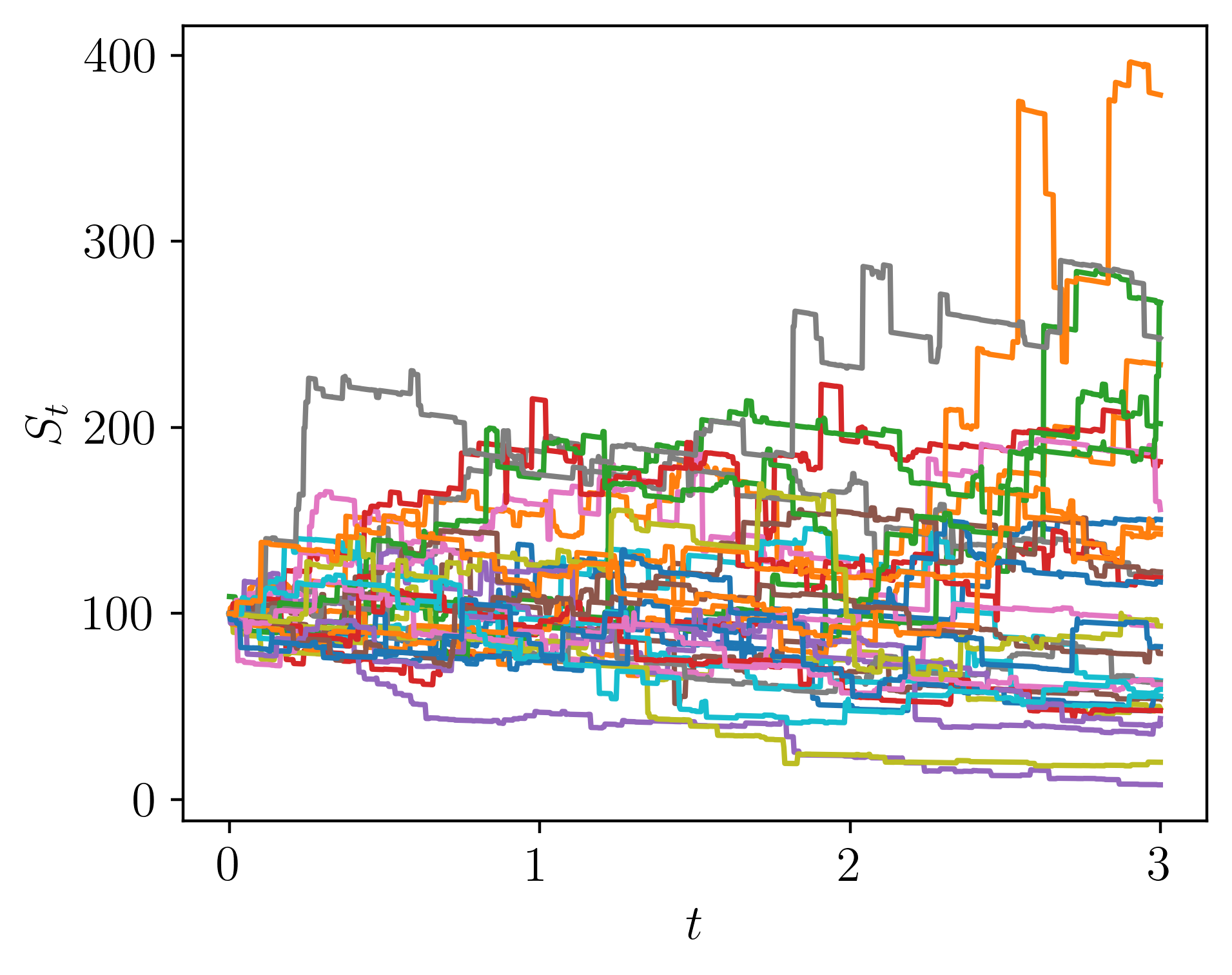

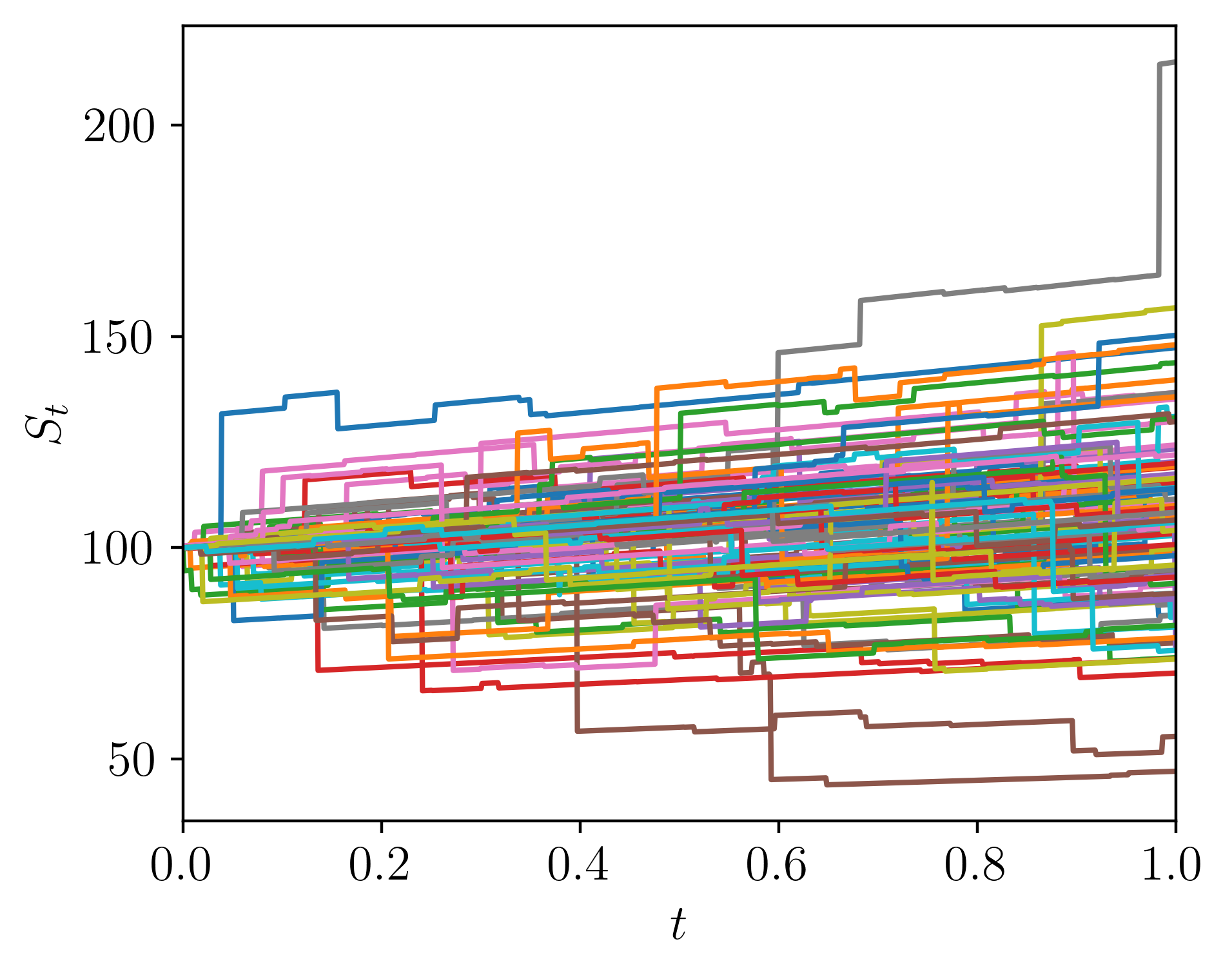

- gamma

- variance gamma

- bilateral gamma

- Poisson

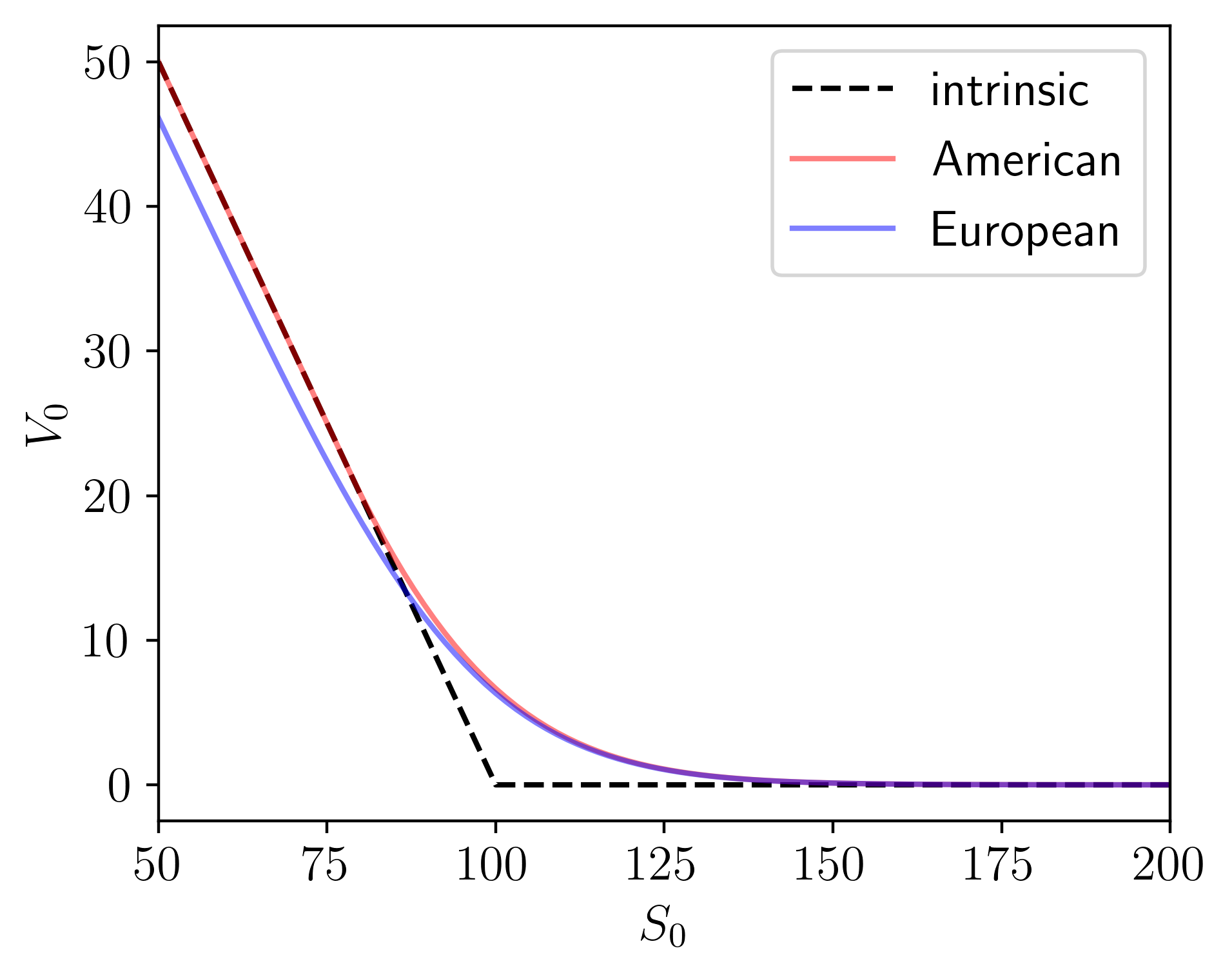

- American option pricing

- binomial tree

- Longstaff-Schwartz

- de-Americanization

- Carr-Madan FFT pricing of European options for

- Black-Scholes-Merton

- variance gamma

- bilateral gamma

- PDE pricing

- Black-Scholes PDE

While not necessary, full paths are always generated in Monte Carlo simulations for pricing, so that path-dependent options may be priced also.

Scripts should be ran from within this directory.

Plots are written to the out folder in this directory.